Why should I protect my event with Private Event Insurance?

-

Required by many special event venues

- Protects you if you're held liable for

property damage or

bodily injury

- Offers host liquor liability to protect against

alcohol-related accidents

Why is Private Event Insurance the preferred choice for venue required liability?

Private Event Insurance liability coverage was specifically designed in consultation with venues so we could be sure our product satisfied their requirements for liability & property damage coverage. Many venues refer their clients to us year after year. Private Event Insurance is a sister-program to the leading wedding insurance plan in the USA,

WedSafe Wedding Insurance.

WedSafe is a trusted name in the industry, the top wedding insurance program in the USA and has been protecting couples since 1999. Both Private Event Insurance and WedSafe are brought to you by

Aon plc (NYSE:AON) - the leading global provider of risk management, insurance and reinsurance brokerage, and human resources solutions and outsourcing services.

Plus, our liability insurance is

easy to purchase, competitively priced, and underwritten by an

A rated insurer.

More reasons Private Event Insurance is preferred by customers and their venues:

Get instant upfront pricing online – no need to disclose any personal information or create an account just to get a quote

- Your event venue can be named as Additional Insured at no extra charge (you can even add a second venue for the same low price!)

Seven (7) limit options to choose from*

Can be purchased up to the actual day of your event (if purchased the same day as your event, coverage will be effective at the time payment is confirmed and the purchase is completed).

Purchase online and

you're covered in minutes and receive your coverage documents immediately** (you'll also receive a copy by e-mail)

Certificate of Insurance can be e-mailed directly to your venue

Coverage is

primary for both you and your venue, which means if you have a covered claim your Private Event Insurance policy will pay first – before any other insurance you may have. Primary liability coverage is preferred by most venues, and many require it.

-

Liability coverage can be purchased alone, or as a package with an Event Cancellation / Postponement policy at a discounted rate

Our Event Liability insurance is available to U.S. residents with wedding/events

in all U.S. states, U.S. Territories & Possessions, Canada & Puerto Rico.

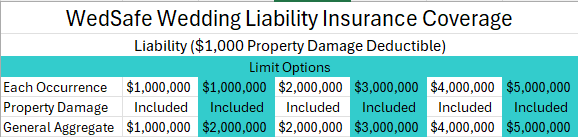

Refer to this chart to review WedSafe liability insurance coverage limit options. If you have questions, call 1-877-723-3933, Monday through Friday, from 9:00 a.m. – 8:00 p.m. ET, to speak to a Client Relationship Specialist.

![]()

*Please note: Some coverage options & limits are not yet available in all states. Use the Get a Quote button to see available coverage options and limits for your state, or contact customer service for more information.

**In some cases, if your venue requires special wording to be added to the Certificate of Insurance, we will need to review the wording before a special certificate of insurance can be issued. This may take up to 1 business day. When your wording is approved we will send your certificate via e-mail.